How Foreign Stocks Are Declared in Indian Income Tax Returns (ITR)

As Indian investors increasingly diversify their portfolios by investing in global markets, it’s essential to understand how to correctly declare foreign stocks in your Income Tax Returns (ITR). If you’re a resident Indian holding foreign equity shares, the Income Tax Department mandates detailed reporting of these assets — even if they don’t generate income during the year.

In this guide, we’ll walk you through how foreign investments, especially stocks, are declared in your ITR, along with practical examples, tips, and compliance guidelines

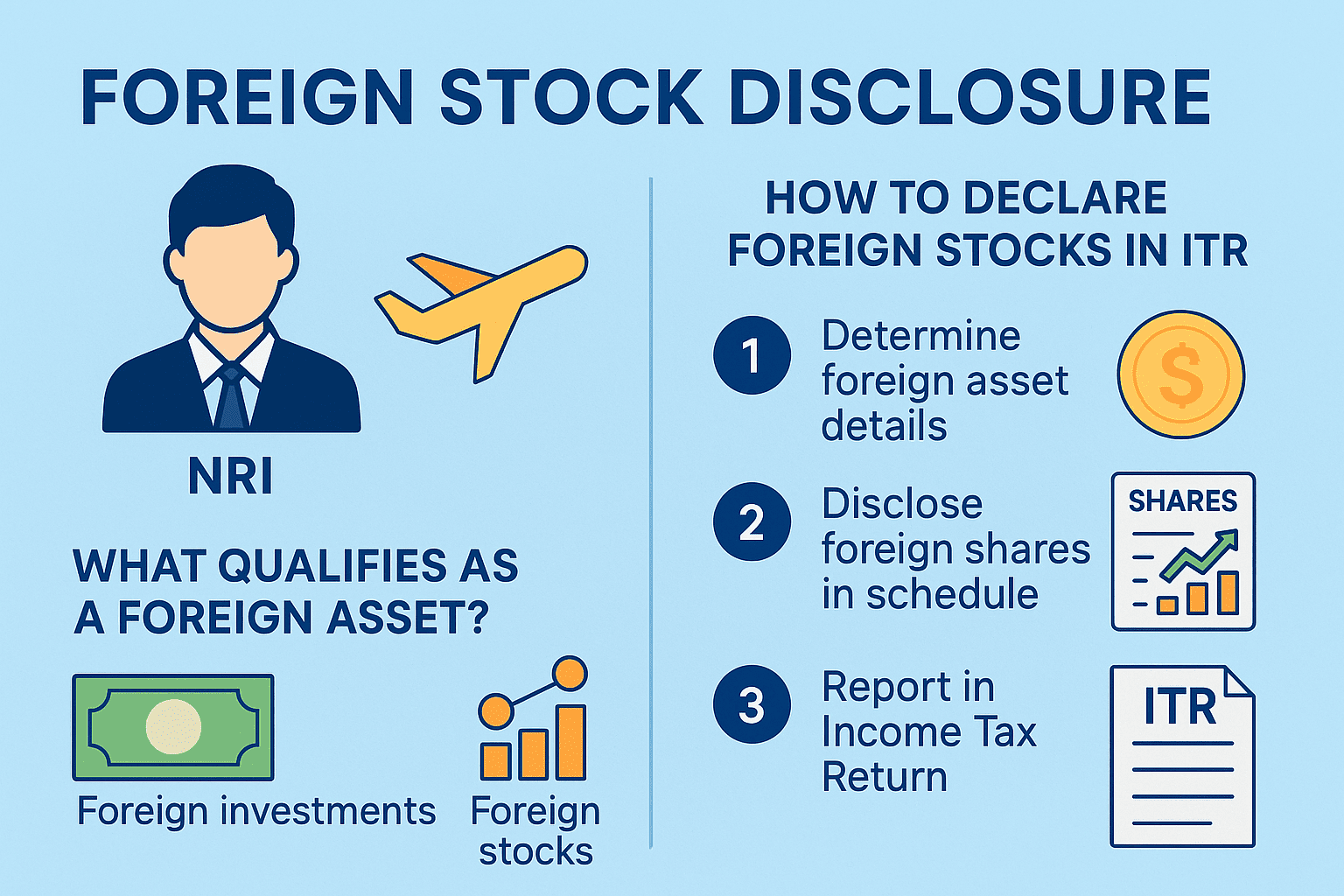

What Are Foreign Assets?

Foreign assets include:

Foreign equity shares (e.g., stocks of Apple, Tesla, Amazon)

Foreign mutual funds or ETFs

Foreign bank accounts

Real estate abroad

Foreign demat or custodial accounts

These are reportable under Schedule FA if you’re a Resident and Ordinarily Resident (ROR) in India during the financial year.

What is Schedule FA?

Schedule FA (Foreign Assets) is a dedicated section in the ITR that requires details of:

Foreign bank accounts

Foreign custodial accounts (like Zerodha International, Interactive Brokers)

Foreign equity or debt interest

Any other foreign income-generating asset

You need to disclose:

Date of acquisition

Initial and closing value of the investment

Income received (dividend, interest)

Sale proceeds (if sold)

Even if the asset did not yield any income, it must still be reported if it was held at any time during the financial year.

Who Needs to File Schedule FA?

Only individuals qualifying as Resident and Ordinarily Resident (ROR) must disclose foreign assets.

How to determine your residency status:

You’re an ROR if you:

Stay in India for 182 days or more in a year AND

Have been a resident in 2 out of the last 10 years, and

Stayed for 730 days or more in the last 7 years

If you’re an NRI or Resident but Not Ordinarily Resident (RNOR), you don’t need to file Schedule FA

Where & How to Declare Foreign Stocks in ITR

1. Schedule FA – Foreign Equity Holding

Disclose:

Name of the company

Country of incorporation

Date of acquisition

Purchase value

Closing value (as of 31st December)

Dividends received (in local currency and INR)

2. Capital Gains Schedule (CG)

If you sold any foreign stocks:

Report under “Capital Gains” section

Provide sale value, cost of acquisition, and date of sale

Calculate gains as short-term or long-term depending on holding period

Foreign stocks are long-term if held for more than 24 months.

3. Income from Other Sources (IFOS)

Declare dividends received from foreign companies here.

Practical Example – Ashwin’s Case

Let’s say Ashwin, a resident Indian, made the following investments in 2022:

| Stock | Invested | Sale Proceeds | Current Value | Dividends Received |

|---|---|---|---|---|

| X | ₹5,000 | Not Sold | ₹5,400 | ₹150 |

| Y | ₹3,000 | ₹3,100 | Not held | NIL |

| Z | ₹2,000 | Not Sold | ₹2,500 | NIL |

Declaring Foreign Custodial Accounts

In Ashwin’s ITR:

He’ll report Stock X in Schedule FA and declare ₹150 dividend under IFOS.

Stock Y’s sale is reported under Capital Gains and also declared in Schedule FA.

Stock Z is only reported in Schedule FA.

If your stocks are held in a foreign broker/demat account, such as:

Interactive Brokers

Charles Schwab

TD Ameritrade

Then declare this account under “Foreign Custodial Accounts” in Schedule FA.

You’ll need:

Account number

Peak balance during the year

Closing balance (as on 31st Dec)

Total income credited (dividends, sales, etc.)

Foreign Tax Credit (FTC) – Claim Tax Relief on Dividends

Many foreign countries (e.g., USA) deduct tax at source on dividends. In such cases, you can claim foreign tax credit (FTC) in India by:

Steps to Claim FTC:

File Form 67 online before filing your ITR

Submit details of tax deducted abroad and attach proof (broker statement)

In ITR, claim relief under Section 90/91

Example:

Dividend received from USA: ₹8,19,500

Tax withheld in USA @25% = ₹2,04,875

You can claim this amount as FTC, reducing your total tax liability in India.

Note: FTC allowed is the lower of:

Tax paid in foreign country

Tax payable in India on that income

Compliance Rules, Timelines & Penalties

| Requirement | Description |

|---|---|

| Filing Deadline | 31st July (for individuals not requiring audit) |

| Form to use | ITR-2 (for capital gains & foreign assets) |

| Form 67 | Must be submitted before ITR to claim FTC |

| Penalty for non-disclosure | ₹10 lakhs under Black Money Act for undisclosed foreign assets |

FAQs

Q1. Do I need to report foreign stocks if I didn’t sell them?

Ans. Yes, all foreign assets must be declared in Schedule FA even if no income or sale occurred.

Q2. Can I skip Form 67 if no tax was deducted abroad?

Ans. Yes, Form 67 is only required if you claim foreign tax credit.

Q3. What if I forget to declare a foreign asset?

Ans. It could lead to penalties up to ₹10 lakhs under the Black Money Act.